Non-Farm Payrolls (May 2017)

Considered one of the most important employment and economic strength indicators, nonfarm payrolls will be reported at the end of this week for May 2017. The US Bureau of Labor Statistics will release the monthly data on Friday 2nd June 2017 8:30 a.m. EDT as part of its monthly Employment Situation Report. The Non-farms figure specifically provides the change in the total number of nonfarm payrolls compared to the previous month – representing all jobs except those related to farm work, unincorporated self-employment, and employment by private households, the military and intelligence agencies.

This figure signals the strength of the US labour market to global investors and economists and provides an indication of what to expect from the global powerhouse US economy continuing through 2017.

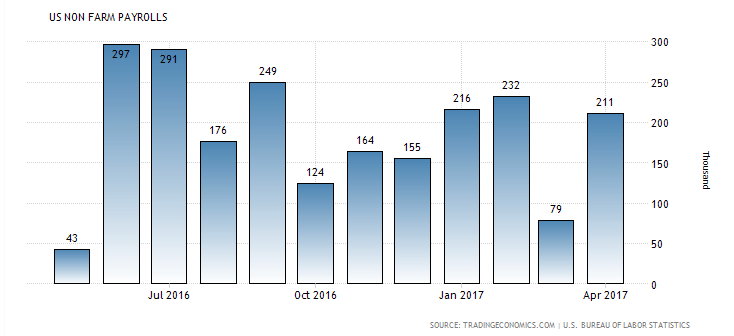

Data on Nonfarm payrolls is reported on the first Friday of every month and is watched closely by market participants – then applied towards helping policymakers make forecasts and decisions regarding the future of the US economy. In April 2017, nonfarm payrolls rose by a seasonally adjusted 211,000 – far exceeding the 185,000 consensus expectation and marking the 79th consecutive month of job growth. *

The consensus expectation for May 2017, according to Reuters, is for an increase of 182,000 jobs within the US economy – adding to the strong run of jobs growth as represented by this indicator and further continuing the historical trend of strong jobs numbers for the month of May annually.**

The total nonfarm payroll figure accounts for approximately 80% of the workers who produce the aggregate US GDP. Therefore, crucially, the figure reported is a powerful sentiment indicator – it has the power to impact the stock market, monetary policy, gold and the US dollar and much more. This month we expect a positive number – continuing a steady uptrend in the strength of the US economy.** This leads to expectation of a further strengthening dollar and increased likelihood of the two rates hikes that have already been priced into the market.**

However, it is the balance against inflation figures that determine the overall economic policy and outcomes. CPI is forecasted to remain sluggish – placing a dampening effect on forecasts of economic strength compared with if we considered jobs data alone. **

Investors will be keeping a close eye on the upcoming CPI figures – which will be reported June 14th 2017. This will be followed by an announcement from the Fed on the same day regarding interest rates and their official statement of economic progress. Wages have experienced a moderate amount of growth during 2017* which gives a strong indication of a rate rise in June – most market participants are forecasting a quarter point rise at this time.**

Overall the US jobs market does appear to be strengthening – with both wages and employment rising at a steady and consistent pace. * US economists have calculated that the US economy requires the creation of between 75,000- 100,000 working-age jobs per month to maintain pace with economic growth. Job growth averaged 178,000 per month in the first quarter of 2017 – although this falls short of the target figures it demonstrates an improvement and movement in the right direction.* Further to this a US government report announced in April that they had found private sector wages achieved their largest gain in a decade during the first quarter of 2017.

Prudent investors will also be factoring in the US political climate. Despite the positive impact of jobs data and Fed policy, we can furthermore expect significant volatility in the dollar through the remainder of 2017 – given the uncertainty in international relations and the headline grabbing actions of US President Donald Trump. **

* Past performance is not a reliable indicator of future performance.

** Forecasts are not reliable indicator of future performance.